An additional endorsement that could bring you peace of mind is Limited Water Damage Coverage. These are losses caused by water or water-borne material that backs up through sewers or drains from off the insured premises; water that overflows or discharges from a sump pump or related equipment; or water that exerts pressure or seeps from below the surface of the ground through an insured structure. This coverage is not flood insurance; Wallace & Turner can answer your questions about this separate coverage. Contact us at (937) 324-8492 or lmiller@wtins.com.

Bring Your Dog to Work Day 2019

In honor of Bring Your Dog to Work Day, we’re sharing photos of our favorite four-legged employees!

Flood Solutions: Insurance Against the #1 Natural Disaster

Flooding is the largest natural catastrophe and largest single event natural catastrophe that ever occurs, and only 7% of homeowners have flood insurance! Floods are not covered in your homeowners policy, but anyone can get the coverage as a supplement to their homeowners.

Flood insurance coverage to complement your homeowner policy.

We work with Cincinnati Insurance Company to offer Preferred Primary Flood or Excess Flood Endorsements as alternatives to insurance available from the National Flood Insurance Program.

Learn more about types of flood insurance, costs andwhy it’s important to have this coverage. Read How Much is Flood Insurance in Ohio?

Contact Wallace & Turner at (937) 324-8492 or info@wtins.com to discuss your options for flood coverage.

Insurance.com Interviews P.J. Miller on Factors That Impact Auto Insurance Rates

P.J. Miller

In an interview with Insurance.com, independent insurance agent and partner P.J. Miller noted that auto insurance rates vary by state for many reasons.

"Typically, there are different legal mandates or requirements that are more liberal to the injured party, making it easier to receive a greater settlement [thereby raising costs for the insurance company]," Miller says. "Lower labor rates, lower parts prices for vehicles, lower sales tax rates, fewer vehicles on the road, and mandatory auto insurance are a few of the factors that tend to keep rates down."

One factor that might surprise drivers is their credit score. Nearly every state allows insurers to base their rates at least partially on a person’s credit history.

"Most carriers use credit as a portion of the rate-setting process, where permitted by law. While it is supposed to be a portion of the rate calculation, most believe it plays a significant role in determining price," Miller said. "There are countless other factors that enter into the behind-the-scenes formulation that make it almost impossible to know exactly why you pay, or are quoted, the final rate."

Sticking to the state minimum will limit your costs, but it will also increase your risk. Miller commented that states typically have an incredibly low minimum mandatory limit. “Keep in mind that $25,000 doesn’t go far in crashes.”

When you shop for car insurance, first determine what level of coverage suits your needs.

Depending on the age of your vehicle, you might not need comprehensive and collision coverage. Miller also advised the following:

Combine your coverage: Bundle auto coverage with your home or renters’ insurance policy: Showing your loyalty to one insurer could help you land a discount, especially if you have multiple policies. Renew your plan early and you could get a discount, as well.

Be a good driver: "Speeding tickets can dramatically impact your rates," Miller said. Being a safe driver can lower your car insurance by 5% typically. Driving fewer miles a year will also reduce your rate.

Read the full article at Insurance.com.

If you have questions regarding auto insurance, please contact Wallace & Turner at (937) 324-8492 or via our contact form.

Wallace & Turner Once Again Sponsors Happy Half Marathon for 2019

The first official Happy Half Marathon was held in 2012, and the race brings together 200+ runners to support a cause and gives participants a chance to achieve their fitness goals. Wallace & Turner will again support the event as a Water Table Sponsor.

The idea for the race comes from family members running the 13.1 mile course from Springfield to Yellow Springs to train for a full-marathon in which they would be raising money to help cover the cost of cancer treatment for Mike Maloney, father of Co-Director Alex Maloney.

In 2018, the marathon saw record numbers with 256 runners, more than 170 volunteers, and 13 community sponsors. Most importantly, the Happy Half Marathon and the community sponsors donated $11,000 to the Springfield Regional Cancer Center.

Wallace & Turner Partners with Nationwide Insurance to Write Personal & Commercial Coverage

Wallace & Turner is now working alongside nationally-renowned Nationwide Insurance to write a full range of personal and commercial insurance policies. Nationwide, a Fortune 100 company based in Columbus, Ohio, is one of the largest and strongest diversified insurance and financial services organizations in the United States.

“For our clients, this translates into another option for dependable insurance coverage that suits their needs and budget,” commented Wallace & Turner partner P.J. Miller. “Nationwide offers unique financial incentives and a broad scope of coverages.”

Grown from a small mutual auto insurance company, owned by policyholders who spent their days farming in Ohio, Nationwide’s coverage now extends to auto, home, life, small business and other personal and commercial insurance.

View Wallace & Turner’s complete list of insurance partners here and contact us to learn more about coverage options.

About Wallace & Turner, Inc.

Wallace & Turner has operated locally in Springfield, Ohio since 1870 and provides personal insurance, commercial insurance and life & health coverage. It is a member agency of Associated Risk Managers International, Keystone Insurers Group, Trusted Choice and Ohio Insurance Agents Association, as well as a long-standing member of the Independent Insurance Agents Association, both in Ohio and nationally.

About Nationwide

Nationwide, a Fortune 100 company based in Columbus, Ohio, is one of the largest and strongest diversified insurance and financial services organizations in the U.S. and is rated A+ by both A.M. Best and Standard & Poor’s. The company provides a full range of insurance and financial services, including auto, commercial, homeowners, farm and life insurance; public and private sector retirement plans, annuities and mutual funds; banking and mortgages; excess & surplus, specialty and surety; pet, motorcycle and boat insurance. For more information, visit www.nationwide.com

Myles Trempe Quoted in FitSmallBusiness on Why Small Businesses Should Consider Commercial Auto Insurance

Running your own business increases your financial and reputational risk, so it’s important to protect yourself by insuring both your company and your employees. Some small business owners commit mistakes when taking out an insurance policy that creates problems later on. Producer Myles Trempe was interviewed by FitSmallBusiness on why small businesses should consider commercial auto insurance.

Myles commented, “If a small business operates company cars, vans, or trucks, there is a great likelihood they need commercial auto insurance. Business owners oftentimes distort the lines between personal auto insurance and commercial auto insurance. A standard personal auto insurance policy has limitations or exclusions relating to the business use of a personal auto. Therefore, small business owners need commercial auto insurance to protect against auto liability for bodily injury and property damage to a third party. A commercial auto policy is critical for protecting the business financially, and is required by the law. A general liability policy for the business does not cover the costs of claims that arise from work-related auto accidents.”

Read the full article, “Top 25 Small Business Insurance Mistakes to Avoid.”

If you have questions regarding commercial auto insurance, please contact Wallace & Turner at (937) 324-8492 or via our contact form.

WT Participates in Bike to Work Day 2019

In support of promoting fitness in a collaborative and environmentally friendly way, Wallace & Turner participated in Bike to Work Day 2019 in Springfield. Bike to Work Day encourages healthier lifestyles as well as a more environmentally friendly mode of transportation. Pictured below is Operations Manager & Commercial Lines Account Manager Lisa Miller with her son, Zach. Unfortunately, Lisa experienced a flat on the ride but Bicycle Revival was there to save the day! Big thanks to Mike Groeber for the quick fix!

Ben Galbreath Presents at The Chamber of Greater Springfield - Connect 4 Coffee

Our newest Producer Ben Galbreath joined the The Chamber of Greater Springfield - OH's Connect 4 Coffee event on May 9, 2019. Check out minute 12:48 mark to learn more about Ben and Wallace & Turner's insurance services for the greater Springfield community.

Ben Galbreath Joins Wallace & Turner Insurance as a Producer

SPRINGFIELD, Ohio – Wallace & Turner Insurance is pleased to announce that Ben Galbreath has joined as a Producer. Galbreath has more than 15 years of experience in personal, commercial, farm, life and supplemental benefits insurance.

“Ben’s diverse insurance expertise and relationships in the industry will greatly benefit our valued clients,” commented Vice President and Partner, P.J. Miller. “His approach and commitment to customer service align well with our core values, and we know he will strengthen our ability to serve the greater Springfield area’s insurance needs.”

“Wallace & Turner has an excellent reputation and I’m grateful for the opportunity to join this well-respected team,” said Galbreath. “As a Springfield native, I look forward to providing cost-effective insurance solutions to my friends and neighbors.”

Previously, Galbreath was an independent insurance agent with Guild and Landis, which was purchased by BD Capital Partners and subsequently bought by NFP Inc.

Galbreath obtained a Bachelor of Arts from Kent State University. He is licensed in property & casualty, life and health insurance by A.D. Banker & Company, and has a farm certification from Nationwide Insurance Company.

###

Wallace & Turner has operated locally in Springfield, Ohio since 1870 and provides personal insurance, commercial insurance and life & health coverage. It is a member agency of Associated Risk Managers International, Keystone Insurers Group, Trusted Choice and Ohio Insurance Agents Association, as well as a long-standing member of the Independent Insurance Agents Association, both in Ohio and nationally.

Keep Clark County Beautiful Day 2019 at WellSpring

The WT ladies got their hands dirty cleaning, mulching and planting the bed at WellSpring to celebrate Keep Clark County Beautiful Day 2019. The WT gentlemen stayed behind to man the fort.

The Fuller Center for Housing 2019 Spring Celebration

Chris Johnston Participates in 5K Color Run to Benefit Developmental Disabilities of Clark County

On April 27, 2019, Policy Processor and Receptionist, Chris Johnston ran a 5K in The Color Run to benefit Developmental Disabilities of Clark County. Little did she know that it would be 32 degrees and a cross country type course, but she did it and came in 10th place in her age group!

Myles Trempe Quoted by U.S. Chamber of Commerce on Professional Liability Insurance

Producer Myles Trempe was interviewed by the U.S. Chamber of Commerce for the article “Everything You Need to Know About Professional Liability Insurance.” There are several types of insurance policies that small business owners should have in place, and for many businesses, professional liability insurance should be at the top of the list.

Regarding the cost of professional liability insurance, the article noted that many small business owners often assume that professional liability coverage is not affordable, but if you’re not in a risky profession such as a doctor or lawyer, a policy is relatively inexpensive.

Myles commented, “Professional liability coverage can be purchased as an endorsement to your business owner’s policy or as a separate policy unto itself.”

Be forewarned, however: Professional liability insurance doesn’t shield you from every possible scenario.

If you have questions about professional liability insurance, please contact Wallace & Turner Insurance at (937) 324-8492 or info@wtins.com.

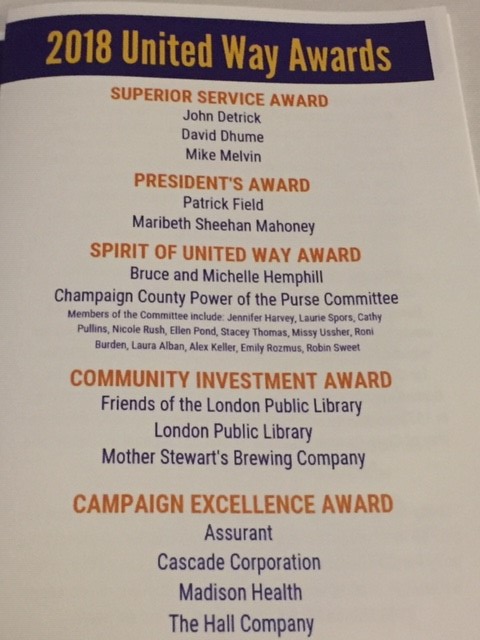

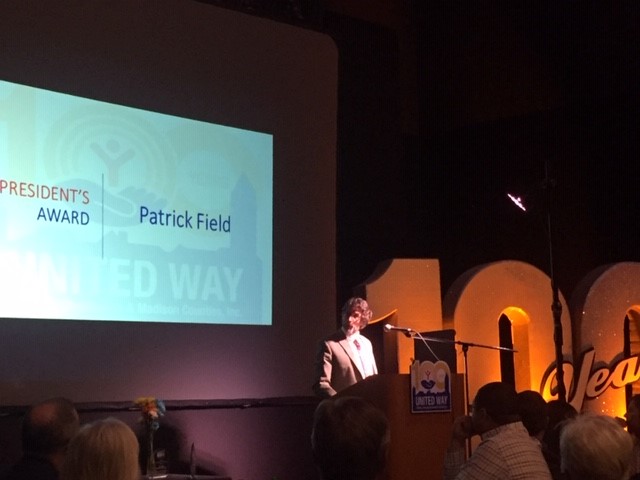

Patrick Field Recognized with the United Way President's Award for Contributions to the Organization

Congratulations to the recipients of the 2018 United Way Awards, including our very own Patrick Field! Patrick received the President’s Award for his outstanding volunteer involvement with United Way.

According to United Way: “To know Patrick Field is to know that he is nothing but honest and truthful in offering support. And there is absolutely no doubt that he loves Springfield and works tirelessly to make our town better. He is a friend to many in this community and United Way is certainly no exception. Patrick is a connector, relationship-builder and never hesitates to help United Way connect with other leaders and businesses in both Clark and Champaign County. His keen insight into nonprofits often leads to new messaging to better reach donors. Patrick is a partner with Wallace & Turner, and he also owns the Coppertop Restaurant in Urbana, Ohio. which is listed as part of our Club 52 Card. Through Patrick’s leadership and generosity our United Way continues to move forward serving our three counties.”

Wallace & Turner was also recognized as a partner who believes in United Way and “Lives United.” We are proud of our contributions that help many organizations throughout Clark, Champaign and Madison Counties.

Fundera Turns to P.J. Miller for Insights on Business Interruption Insurance Coverage

Partner P.J. Miller was interviewed by Fundera for the article “Business Interruption Insurance: What It Covers and Where to Get It” and discussed business interruption insurance coverage for online and in-home businesses.

Business interruption insurance is a very specific type of coverage designed to keep a business on its feet when it’s recovering from a disaster or unexpected situation. Business interruption insurance covers lost income and operating expenses when a disaster forces a business to slow operations or temporarily close down. Coverage can be purchased as part of a business owner’s policy or added on to a commercial property policy.

If you have a brick-and-mortar business, you’re most in need of business interruption insurance because you heavily depend on your store and the physical assets inside it. If you need to close down a portion or all of your shop, you clearly lose potential customers. Home-based and online business owners have less of a need for business interruption insurance, but should still consider their situation. Most homeowners policies won’t cover lost business income. And although online businesses might have their own physical assets, business interruption insurance can still help if a supplier in your supply chain is affected by a disaster.

According to P.J. Miller, partner, vice president and chairman of the board at Wallace & Turner Insurance, “Online and, to a lesser degree, in-home businesses could actually be dependent on off-premises, non-owned locations being insured, whether it’s a storage unit or out of state from a company that supplies or ships the goods you’re selling. There’s business interruption insurance if, for example, your loss is due to the fire that destroyed the warehouse/manufacturing plant that is possibly your sole supplier.”

If you have questions regarding business interruption insurance, please contact Wallace & Turner Insurance at (937) 324-8492 or info@wtins.com.

Meet Wile E - WT's Newest "Employee"!

Congrats to Partner Patrick Field on winning Wile E at the Catholic Central Emerald Evening Gala Auction!

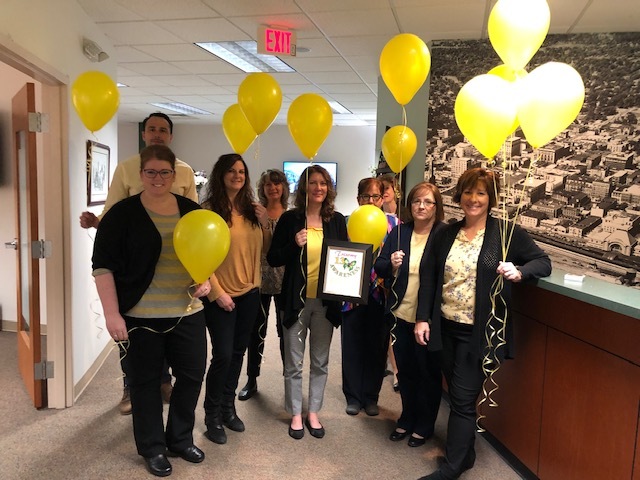

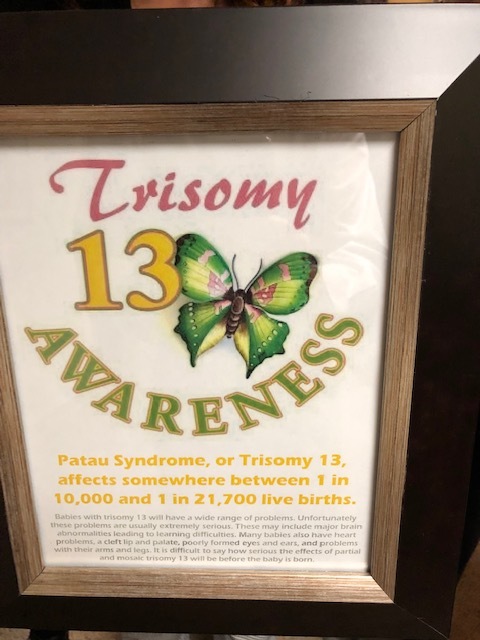

Wallace & Turner Wears Yellow in Honor of Trisomy Awareness Month

March is Trisomy Awareness Month and more specifically, today is Trisomy 13 day, so today Wallace & Turner is wearing yellow in honor of those who have been touched by this disorder. Trisomy is a genetic disorder in which a third chromosome is present in one of the genetic pairs.

Wallace & Turner has been personally touched by the disorder as Lisa Miller’s cousin, Donald Hutzler’s 10 month old granddaughter has Trisomy 13 and Emily Dinnen lost a sister, Allison, to Trisomy 18.

To learn more about Trisomy and to see Arianna’s battle and story, click below.

https://www.gofundme.com/3typ65-team-ari

https://cedarrapids.citymomsblog.com/struggles/trisomy-awareness-celebrating-atypical-kids-moms/

Leadership Clark County Ohio’s Art of the Cocktail Mardi Gras Celebration!

We had a great time at Leadership Clark County Ohio’s Art of the Cocktail Mardi Gras celebration! Thanks to Seasons Bistro and Grille for hosting!

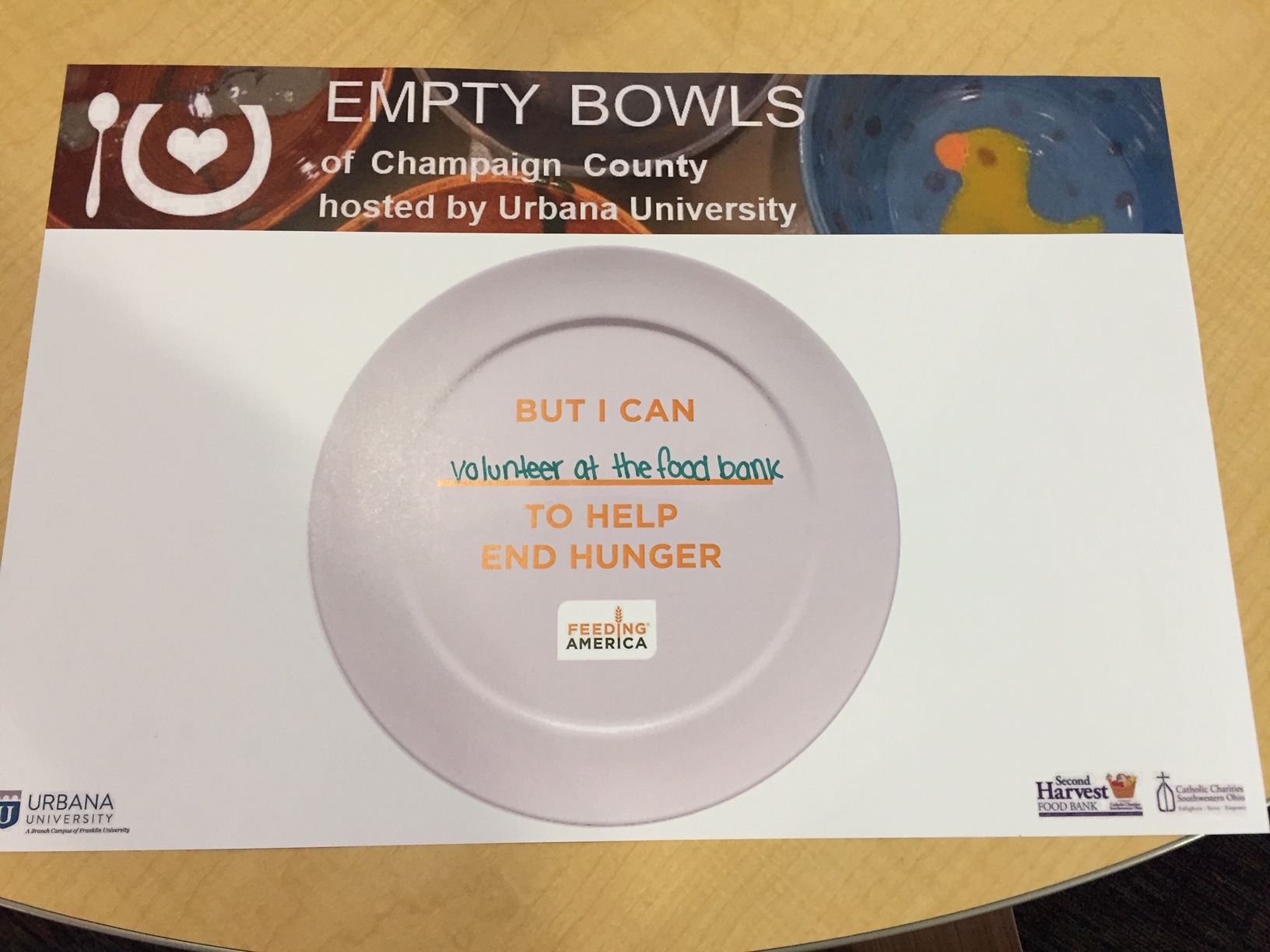

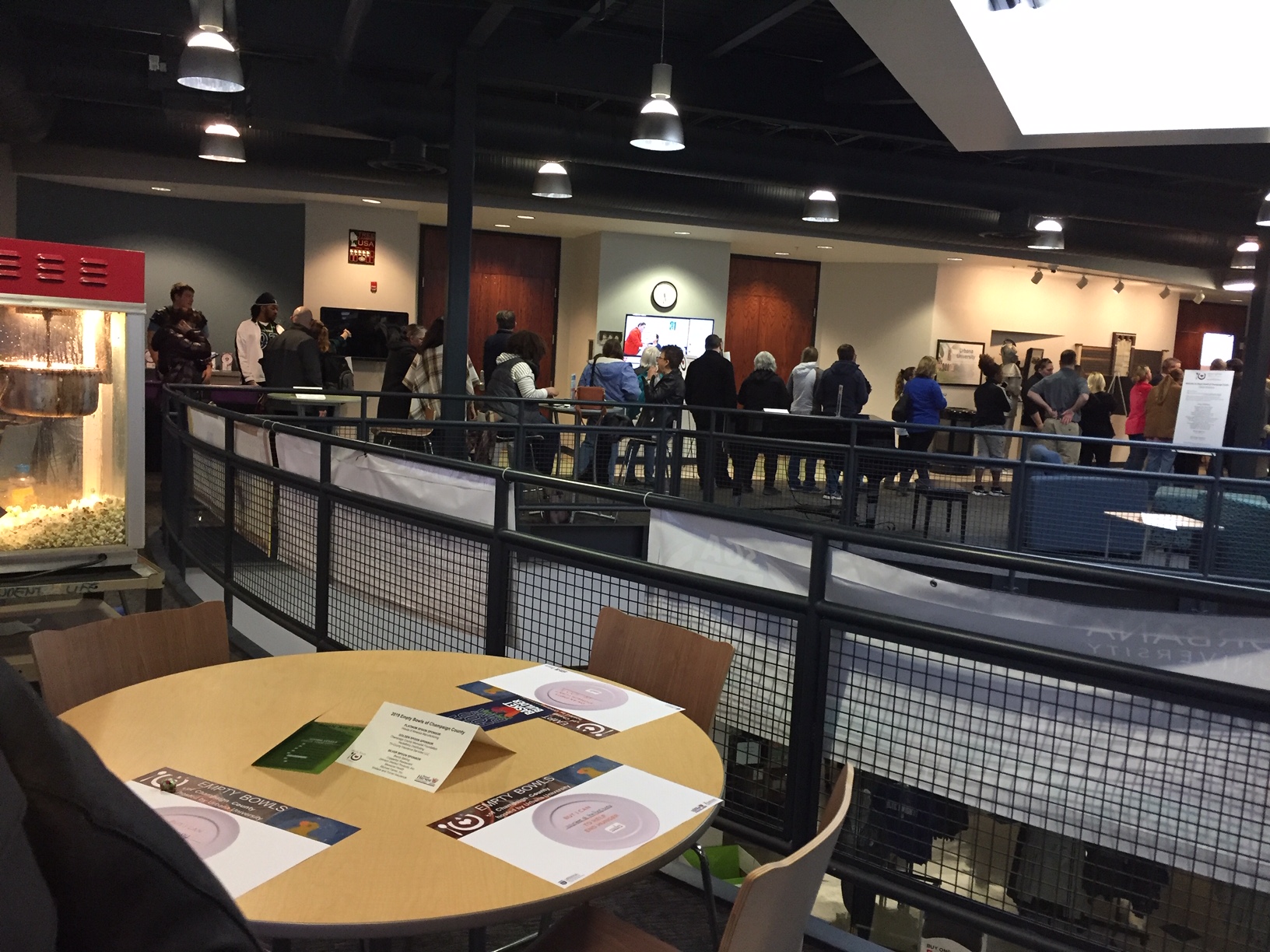

Wallace & Turner Continues Support of Second Harvest Food Bank

Wallace & Turner was thrilled to support this wonderful cause hosted by Second Harvest Food Bank.

The 8th Annual Empty Bowls fundraiser offered beautiful handcrafted bowls with attendees enjoying local soup and bread while reducing food insecurity in the community.