Winter is a season filled with warmth and celebration. But it’s also the time of year when the risk of home fires increases dramatically. According to the National Fire Protection Association (NFPA), home fires peak in December, driven by heating equipment, holiday decorations, candles and electrical hazards. For homeowners, understanding these risks—and knowing how to prevent them—is essential for your safety and protecting your home.

Below is a guide to the most common winter fire hazards and the steps you can take to minimize risk.

Space Heaters: Convenient but High Risk

Space heaters remain one of the top causes of fires. While they provide quick warmth, especially in older homes or drafty rooms, they also pose significant dangers if misused.

Key Space Heater Risks

Too-close proximity to combustibles (curtains, bedding, furniture)

Tipping over, especially older models without automatic shut-off

Overloading electrical outlets

Using extension cords or power strips, which can overheat

Prevention Tips

Follow the three-foot rule: Keep anything flammable at least three feet away.

Use heaters with tip-over protection and overheat sensors.

Plug directly into a wall outlet, never an extension cord.

Turn space heaters off when you leave the room or go to bed.

Inspect cords regularly for cracking or fraying.

Insurance note: Many policies require homeowners to take “reasonable precautions.” Improper use of space heaters may complicate a claim if they were used unsafely.

Chimneys & Fireplaces Require Maintenance

A crackling fire is the essence of winter comfort, but poorly maintained chimneys are a major fire hazard.

Key Fireplace Risks

Creosote buildup inside chimneys, which is highly flammable

Cracked chimney liners that allow heat to reach the home’s structure

Sparks or embers escaping the fireplace

Using improper fuel (e.g., trash, cardboard, plastics)

Prevention Tips

Schedule a professional chimney inspection and cleaning once per year, ideally before winter.

Use a sturdy screen or glass doors to prevent sparks.

Burn only dry, seasoned wood.

Never leave a fire unattended, especially if children or pets are nearby.

Fully extinguish the fire before leaving the house or going to bed.

Insurance note: Having up-to-date chimney inspections can help streamline fire-related claims and demonstrate proper home maintenance.

Christmas Trees: Beautiful but Flammable

A dry Christmas tree can ignite and engulf a living room in seconds. Both real and artificial trees come with risks.

Key Christmas Tree Risks

Dry, brittle needles on natural trees

Faulty lights or overloaded electrical outlets

Candles placed too close to the tree

Portable heaters blowing warm air onto branches

Prevention Tips

For real trees:

Choose a fresh tree with sap and flexible needles.

Water daily. Trees can dry out faster than you think.

Keep the tree at least three feet from heat sources.

For artificial trees:

Look for the label “fire-resistant.”

Avoid placing near fireplaces, radiators or space heaters.

For lighting:

Use UL-listed lights appropriate for indoor use.

Throw away any string lights with frayed wires or broken bulbs.

Turn off all tree lights before bed or leaving the house.

Insurance note: Fires involving Christmas trees can spread rapidly, resulting in extensive property damage and higher claims. Regular watering, safe lighting and heat-source clearance are simple steps that can significantly reduce exposure.

Candles: Small Flames, Big Hazards

Candles contribute to holiday ambiance, but they are a leading cause of winter home fires.

Key Candle Risks

Being left unattended

Placing candles near flammable decorations

Using unstable candle holders

Pets or children knocking candles over

Prevention Tips

Keep candles at least 12 inches away from anything that can burn.

Use sturdy, non-tip holders.

Never leave a burning candle unattended, even for a few minutes.

Consider battery-operated, flameless candles for décor-heavy areas.

Insurance note: If a candle fire occurs while a homeowner was away from the room, insurers may scrutinize the event. Prevention is key.

Holiday Décor & Lights: Festive but Potentially Faulty

From elaborate yard displays to indoor garlands and wreaths, holiday décor brings joy—but also introduces additional electrical and fire risks.

Key Holiday Décor Risks

Overloaded circuits

Old or damaged light strings

Indoor lights used outdoors

Exposed wires near flammable materials

Overheated extension cords

Prevention Tips

Inspect all lights for fraying or broken bulbs.

Don’t connect more strings together than manufacturers recommend.

Use outdoor-rated cords and lights for exterior decorations.

Keep electrical cords away from snow, standing water and walkways.

Turn off all decorations before bed or leaving the home.

Insurance note: Documenting your décor setup and using outdoor-rated equipment helps prevent electrical fires and supports any related insurance claims.

Cooking-Related Fires During the Holidays

Winter holiday cooking—big meals, crowded kitchens and distractions—makes this one of the most common sources of home fires.

Key Cooking Risks

Leaving cooking unattended

Grease fires on stovetops

Overcrowded ovens

Flammable items placed near burners

Prevention Tips

Stay in the kitchen when frying, grilling or broiling.

Keep a lid nearby to smother grease fires—never use water.

Keep flammable objects (towels, pot holders, packaging) away from the stovetop.

Make sure smoke alarms are fully operational before heavy cooking periods.

Insurance note: Many kitchen fires stem from momentary distractions. Active supervision and basic precautions can reduce the likelihood and severity of an insurance claim.

Electrical Overload: More Devices, More Risk

Winter tends to bring more electrical usage—heaters, holiday lights, charging stations and kitchen appliances all converge.

Key Electrical Risks

Overloaded circuits or power strips

Loose electrical connections

Aging wiring in older homes

Damaged cords under rugs or furniture

Prevention Tips

Plug high-wattage appliances directly into wall outlets.

Avoid daisy-chaining power strips.

Look for outlets that feel warm—this is a warning sign.

Upgrade old wiring if you live in an older home.

Insurance note: Electrical issues often cause severe fires with significant claims. Proactive upgrades can reduce risk.

Smoke Alarms & Fire Extinguishers: Your First Line of Defense

Even with the best prevention efforts, accidents can happen. Working smoke alarms and accessible fire extinguishers save lives.

Best Practices

Install smoke alarms on every level of the home, inside bedrooms and hallways.

Test alarms regularly and replace batteries annually.

Replace entire units every 10 years.

Keep a Class ABC fire extinguisher in accessible locations—kitchen, garage, near fireplaces.

Insurance note: Functioning safety devices can help minimize damage and support smoother claims handling.

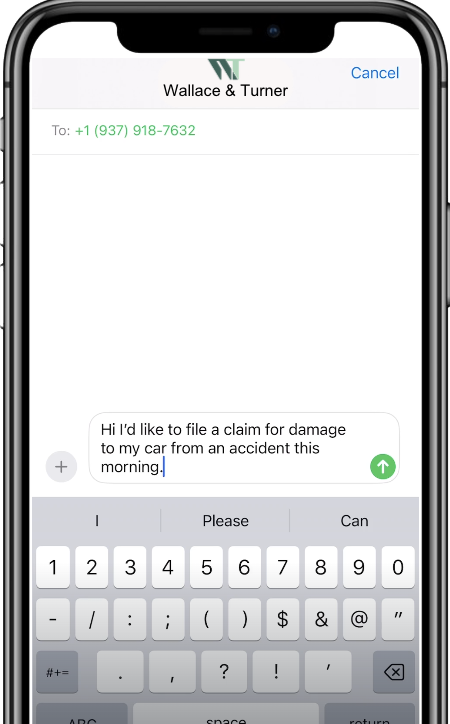

Protect Your Home and Your Family This Winter

Taking these precautions not only protects your property and loved ones but also demonstrates responsible homeownership. If you have questions about homeowners insurance coverage, the Wallace & Turner team is here to help.