Homeowners insurance premiums have been climbing steadily across the country, driven by inflation, extreme weather events, rising construction costs, and higher claim frequency. While some factors are outside your control, insurers price policies based largely on risk—and there are meaningful steps homeowners (and renters) can take to reduce that risk and potentially lower insurance costs over time.

Below are practical strategies that can help reduce premiums while also protecting your home and finances.

Understand How Insurance Pricing Works

Insurance is fundamentally a risk calculation. The more likely an insurer believes you are to file a claim—or the more expensive that claim might be—the higher your premium will be. Factors such as location, home condition, personal financial history and preventative measures all influence pricing.

The good news: many of the steps that make your home safer, more resilient and better maintained can also make you a more attractive policyholder.

Strengthen Home Security

Homes with visible security features are statistically less likely to experience break-ins, vandalism, or theft. Installing security systems—such as alarms, cameras, motion-sensor lighting, or smart locks—can reduce the likelihood of property crime and may qualify you for insurance discounts.

Even modest upgrades can help:

Monitored alarm systems

Door and window sensors

Exterior lighting

Video doorbells

For renters: While you don’t control the structure, many insurers recognize renter-installed security devices. Portable alarm systems, cameras, and smart locks can reduce renter’s insurance premiums while protecting personal belongings.

Weatherproof and Fortify Your Home

Weather-related damage is one of the most common drivers of insurance claims, particularly in areas prone to storms, wildfires or extreme temperatures. Insurers often reward homeowners who proactively protect their home.

Consider improvements such as:

Impact-resistant roofing or shingles

Fire-resistant siding or insulation

Storm shutters or reinforced windows

Improved drainage or water diversion

These upgrades can reduce damage severity during severe weather and, in some cases, help prevent catastrophic loss altogether. Beyond potential insurance savings, these improvements can significantly reduce repair costs after an event.

For renters: Renters can still protect personal property with fire-resistant storage, surge protectors and proper placement of valuables away from windows or flood-prone areas.

Install and Maintain Fire Safety Systems

Fire remains one of the most devastating and costly types of insurance claims. Working smoke detectors, carbon monoxide alarms and fire alert systems dramatically reduce fire risk and may lower insurance premiums.

Best practices include:

Installing smoke detectors on every level of the home

Regularly testing alarms and replacing batteries

Adding monitored fire alarm systems where possible

These relatively low-cost measures improve safety while signaling risk reduction to insurers.

For renters: Smoke detectors are often provided by landlords, but renters should still test them regularly.

Ask us about protecting your home with a free Ting fire sensor and service.

Improve and Maintain Your Credit Score

Many insurers use credit-based insurance scores as part of their underwriting process. Studies consistently show a correlation between strong credit history and lower claims.

Improving your credit profile may help lower premiums over time:

Pay bills consistently and on time

Reduce outstanding debt

Monitor credit reports for errors

While credit alone won’t override location-based risk, it can influence pricing, especially when combined with other risk-reducing behaviors.

For renters: Credit history plays a particularly important role in renter’s insurance pricing, making financial habits even more impactful.

Bundle Insurance Policies

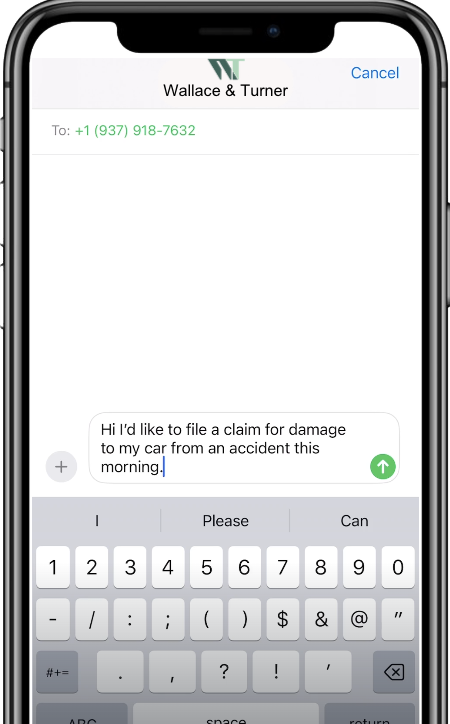

Purchasing multiple policies from the same insurer, such as home and auto insurance, often results in multi-policy discounts. It’s important to talk with an agent about the best options for your specific needs.

For renters: Renters can often bundle renter’s insurance with auto or umbrella policies for similar discounts.

Pay Premiums Annually or Set Up Auto-Pay

How you pay your premium can affect its cost. Some insurers offer discounts for:

Paying the full annual premium upfront

Enrolling in automatic payments

These options reduce administrative costs and payment risk for insurers, savings that may be passed on to policyholders. If cash flow allows, paying annually can also eliminate installment fees that add up over time.

Consider a Higher Deductible

Your deductible is the amount you pay out-of-pocket before insurance coverage applies. Increasing your deductible typically lowers your premium because you’re assuming more financial responsibility when you file a claim.

This strategy works best for homeowners with:

Strong emergency savings

Low claim frequency

Homes in relatively stable risk areas

Be sure the deductible is an amount you could comfortably pay if a loss occurred.

For renters: Higher deductibles on renter’s insurance policies can also reduce monthly costs, especially for those primarily seeking protection against major losses rather than minor claims.

Evaluate Location-Based Risk

Location plays a significant role in insurance pricing. Homes in flood zones, wildfire corridors hurricane-prone regions, or high-crime areas typically face higher premiums.

For some homeowners, relocating to a lower-risk area can significantly reduce insurance costs over time. While relocation isn’t a short-term solution, it’s an important consideration when purchasing a home or renewing a lease.

For renters: Renters have greater flexibility to move between neighborhoods. Comparing renter’s insurance quotes by ZIP code can reveal substantial pricing differences.

Maintain Your Property Proactively

Putting off maintenance increases the likelihood of claims. Insurers may view poorly maintained properties as higher risk. Routine upkeep such as roof inspections, plumbing maintenance, tree trimming and HVAC servicing can prevent small issues from becoming costly insurance claims.

Lowering Risk

Reducing insurance costs isn’t about cutting corners, it’s about lowering risk. Many of the steps that can help reduce premiums also improve safety, protect property and increase long-term financial stability.

Whether you own or rent, being proactive, informed and intentional about risk management can pay dividends well beyond insurance savings.