MEDICARE ENROLLMENT & HEALTH SAVINGS ACCOUNTS

Contact Colleen Corrigan for complimentary and in-person Medicare guidance: (937) 324-8492 Ext: 131 CCorrigan@WTlifehealth.com

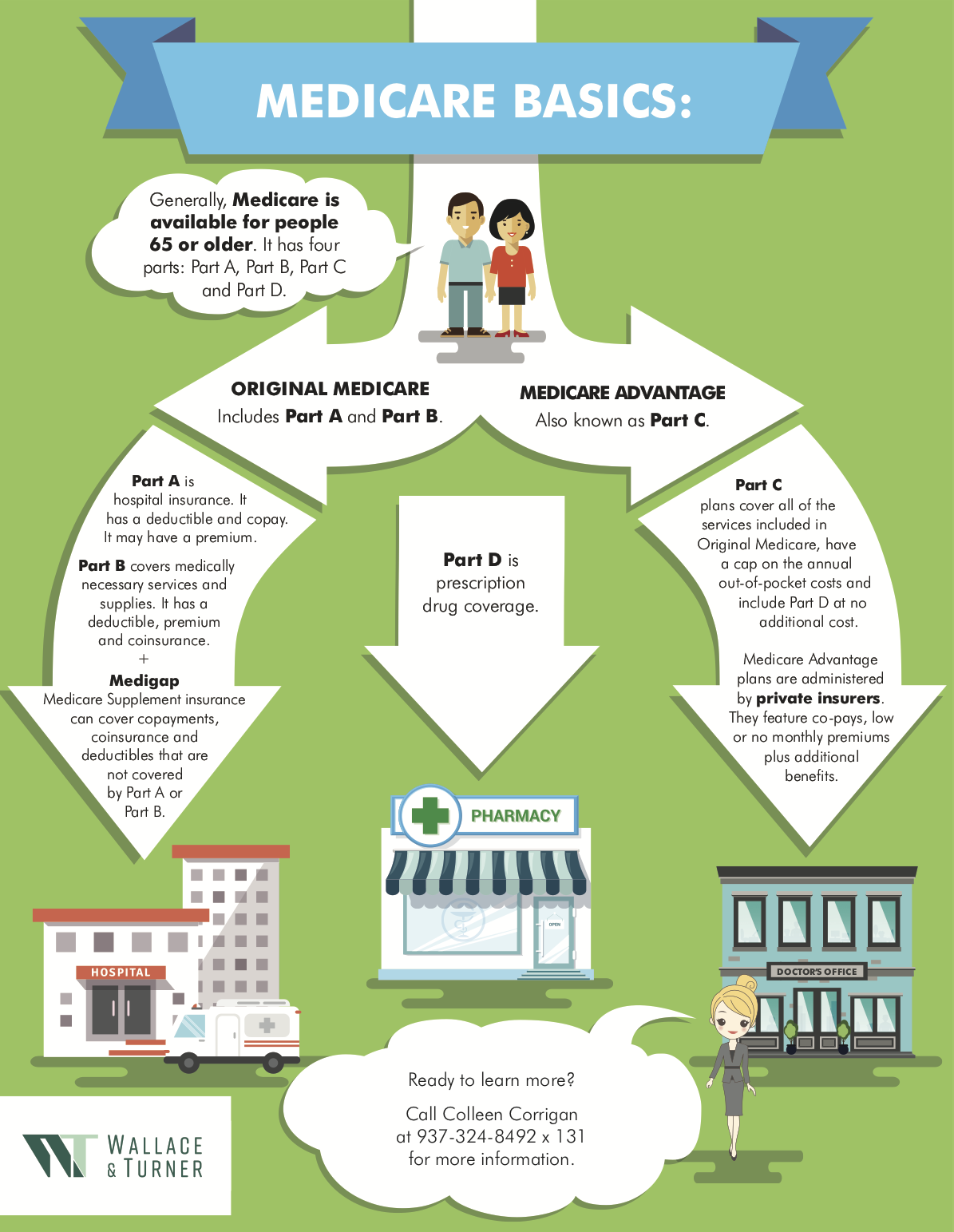

What Medicare Covers

Medicare is a health insurance program available for people 65 or older, individuals under 65 with certain disabilities and people of any age with End Stage Renal. It has four parts: Part A, Part B, Part C and Part D. Over time, Medicare plans have become more robust in nature and some plan options include extras such as:

Prescription drug coverage

Limited dental allowances

Hearing

Vision / eyewear allowance

Fitness membership

Part A is part of Original Medicare

It is usually premium-free for Medicare beneficiaries. If you as the beneficiary or your spouse has worked 40 quarters or 10 years and paid Medicare taxes, you are eligible to receive premium-free Part A. Otherwise, you may pay a monthly premium.

Part A covers:

a) Hospital stays

b) Skilled nursing care after a hospital stay

c) Hospice care

There are inpatient deductibles of $1,676 per benefit period for days 1-60. For inpatient stays beyond 60 days, there is co-insurance of $419 per day until day 90. Days 91 and beyond, there is $742 co-insurance per lifetime reserve day.

Part B is part of Original Medicare

Part B is not premium free. The standard Part B premium is $206.50. High-income households will pay an additional amount based on household tax filing status.

Part B covers:

a) Doctor visits

b) Laboratory tests

c) Diagnostic screening

d) Mental health

e) Outpatient care at hospitals and clinics

f) Emergency care

g) Durable Medicare Equipment (DME)

The 2021 annual deductible for Part B is $257. After the deductible is met, you typically pay 20% of the Medicare approved amount.

Medigap works with Original Medicare to “fill in the gaps” where Original Medicare does not pay. For instance, when you visit the doctor, Original Medicare (your primary insurance) will pay its part of the covered costs.

Then, once Medicare has paid its share, your Supplement will pick up some or all the remaining medical cost. Medicare Supplements can help to insulate you from high medical expenses.

Part C / Medicare Advantage Plans

cover all the services included in Original Medicare (Parts A and B), have a cap on the annual out-of-pocket costs and include Part D at no additional cost.

Medicare Advantage plans are administered by private insurers. They offer co-pays, low or no monthly premiums, plus some additional benefits that Original Medicare does not include. Many of these plans include a network, and a member of this plan must make sure all providers, hospital and healthcare facilities are included.

Part D is coverage for Prescription Drugs

These plans are administered by private insurance companies and have a premium if enrolled in a standalone plan, or are included if enrolled in a Medicare Advantage / C Plan. You must be enrolled in Parts A and B to enroll in a standalone Part D plan.

Medicare Part D prescription drug coverage includes four cost-sharing stages. The amount you pay to fill your prescription drugs depends on the payment stage you are in:

a) Deductible Stage – The maximum deductible is $615. Some plans have lower or no deductible. If your plan has a deductible, you pay 100% of your medication costs until you reach the deductible amount set by your plan.

b) Initial Coverage Stage – During this phase, you pay a co-pay or percentage for your medications and your plan covers the remaining of the retail cost for your covered medications. Costs range.

c) Catastrophic Coverage – Once your out-of-pocket expenses reach $2,100, you automatically enter catastrophic coverage. Once you reach this stage, you no longer pay anything for your prescription drugs for the rest of the year.

Many Medicare beneficiaries will need additional coverage for Dental and Vision expenses. There are a growing number of options based on this gap and need for dental and vision care, and care be purchased as supplemental benefits at low premiums.

Not buying a drug plan and going without creditable drug coverage (meaning coverage equal to or greater than Medicare’s minimum standards of coverage) may result in a Late Enrollment Penalty (LEP) the next time you try to sign up for a drug plan – and depending on how long you go without drug coverage, the penalties can get expensive.

It is important to compare all options available. Many retirees often weigh the differences between an MAPD / Part C and a Medicare Supplement plan, also called Medigap. Both plan types have cost-sharing measures in place to protect you from high out-of-pocket costs you would otherwise be responsible for on Original Medicare.

For the most current Medicare information, visit: https://www.medicare.gov

Growing Popularity in MAPD / Part C Plans

In recent years, MAPD / Part C plans have grown more popular. Many Medicare Beneficiaries are opting out of Original Medicare to purchase an MAPD plan over other plans available. Medicare Supplement plans do not include prescription drug coverage, but prescription coverage can be obtained by purchasing a separate Prescription Drug Plan. Individuals who like to have the convenience and added value that comes with an “all-inclusive” style of coverage will prefer MAPDs.

Wallace & Turner can provide in-depth education, research plan options, and provide multiple Medicare options to ensure successful enrollment and a long-term retirement health insurance relationship. Contact us to learn more.

Health Savings Accounts Important Benefit Information and Reminders

Many employers offer employees a Health Savings Account (HSA) as part of their health benefits program. HSAs are financial accounts made available to employees, so they may contribute funds without paying any taxes on them. All funds that are put into an HSA must be used for qualified medical expenses. If the funds are used for any other purpose, the money will be taxed.

HSAs and Delaying Social Security

If you decide to defer your enrollment in Medicare when you are first eligible and continue with your employer-provided health insurance, it is important to know that this decision impacts your ability to collect Social Security benefits. You must stop all contributions to your HSA six months before you sign up for Medicare Part A. This is because Medicare Part A provides six months of retroactive coverage from the time you apply for Social Security benefits, assuming you were eligible for Medicare during those past six months. Any contributions you make to your HSA will likely be subjected to a penalty because you are not able to contribute to an HSA if you are enrolled in Medicare, even retroactively.

Working with a trusted advisor is highly recommended if you have an HSA account through your employer and want to understand your options leading up to your Medicare Initial Enrollment Period. Proper advanced planning can save you time, stress and money while ensuring you meet the appropriate deadlines without incurring fees or penalties.

Questions about Medicare or other health insurance coverage? We are also able to assist you with navigating enrollment through the Social Security Office. Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.